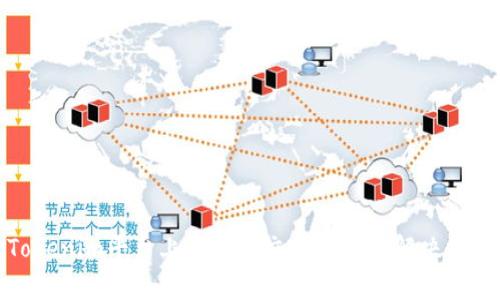

在当前的区块链和加密货币交易环境中,Tokenim作为一个新兴的平台,越来越受到用户的关注。然而,随着其用户量的增加,出现了相同交易的问题,这引发了广泛的讨论和研究。了解并分析相同交易背后的机制,以及如何有效应对这些问题,不仅能够帮助平台提高用户体验,还能增强用户的信任度。

在数字资产的交易中,相同交易通常是指在相同的时间段内,由不同用户发起的相似或完全相同的交易。这些交易可能涉及到相同的资产、数量、以及发送和接收的钱包地址。相同交易的出现,通常会引发关于数据冗余、系统效率以及安全性的问题。

相同交易的产生可以归结为几个因素:

相同交易的出现不仅影响交易效率,还可能对市场的健康发展造成负面影响:

针对相同交易的问题,可以采取以下几种解决方案:

Identifying duplicate transactions on cryptocurrency platforms such as Tokenim is a critical task that involves a combination of data analytics and algorithmic monitoring. Duplicate transactions are generally identified using a variety of techniques, including pattern recognition algorithms, anomaly detection, and transaction clustering. Pattern recognition algorithms can compare characteristics of transactions, such as timestamp, transaction amount, and sender/receiver addresses. When multiple transactions share similar attributes, they are flagged as potential duplicates.

Additionally, anomaly detection techniques can analyze the transaction data for unusual spikes in trading activity at certain times, which may indicate the presence of duplicated transactions. Machine learning models can also be employed to train on historical transaction data to recognize the patterns of duplicates.

Another effective approach is transaction clustering, where transactions are grouped based on similarities. This method allows for a broader analysis, making it easier to spot duplicates by comparing clusters rather than individual transactions. Clustering algorithms help build a more holistic view of trading behavior, identifying instances where multiple users execute the same transactions consecutively.

Ultimately, a combination of these methods - pattern recognition, anomaly detection, and clustering - will enable platforms like Tokenim to efficiently identify and manage duplicate transactions, thereby ensuring the integrity of the trading process.

Yes, duplicate transactions can significantly impact market liquidity. Liquidity refers to how easily assets can be bought or sold in a market without affecting the asset's price. High liquidity is generally considered good for a market, as it allows traders to buy/sell assets quickly and at stable prices. However, when duplicate transactions are repeatedly made, they can create an illusion of higher trading volume, which might initially seem beneficial.

However, these duplicate transactions can ultimately mislead traders about the true state of market liquidity. If many trades are identical and initiated simultaneously, it can create false signals. This scenario could lead traders to assume there is more buying or selling pressure than there really is, influencing their trading decisions unwisely.

Additionally, as the number of duplicate transactions increases, it can contribute to increased network congestion. When a network becomes congested, transactions can take longer to process, reducing overall trading efficiency and, consequently, liquidity. Users may find it challenging to execute trades at desired prices during peak times due to the backlog of similar transactions, negatively affecting the market's operational integrity.

Thus, while duplicate transactions may initially seem to enhance liquidity through increased transaction volume, they can misrepresent true market conditions and potentially decrease liquidity effectiveness in a volatile market.

Tokenim, like many cryptocurrency platforms, utilizes a series of algorithms and mechanisms to effectively manage duplicate transactions. The first step in this process typically involves thorough transaction validation to ensure that all transactions submitted to the network are unique. This primary validation process can include checks on the unique transaction ID, timestamp, and the addresses involved in the transaction.

In cases where duplicate transactions are identified, Tokenim employs a strategy to reject or merge these duplicate entries. Within its transaction handling mechanism, the platform is designed to reject any transaction that carries the same unique identifiers as a previously processed one. This means that if a user attempts to submit a duplicate transaction, the system will notify them and reject the redundant entry.

Moreover, Tokenim may implement a queuing system that holds transactions while they are being verified. This allows for any duplicates to be caught before they are officially processed on the blockchain, thus enhancing security and maintaining an orderly transaction flow. Furthermore, the backend of Tokenim can accommodate separation between potential duplicate situations to avoid unnecessary re-processing of already-confirmed transactions.

In addition to these technical measures, Tokenim may also communicate with users to provide knowledge on best practices when submitting trades, which can further help mitigate issues of duplicate transactions. By educating users on how to maximize their transaction effectiveness and minimize redundant actions, Tokenim actively contributes to fostering a healthy trading ecosystem.

Duplicate transactions can expose cryptocurrency platforms like Tokenim to multiple legal and compliance risks. One major concern is the potential for fraud or manipulation that may be associated with duplicate trading activity. Regulators closely scrutinize trading practices to ensure transparency and fairness in the markets, and duplicate transactions could be perceived as attempts to manipulate prices, creating an unfair trading landscape.

If regulatory authorities identify patterns of concerning behaviors associated with duplicate trades, they may initiate an investigation into the platform's trading practices. This scrutiny may lead to reputational damage, which could in turn affect user trust and new user acquisition. Furthermore, if the platform is found non-compliant with regulatory requirements, it may face hefty fines or other penalties.

Additionally, duplicate transactions can complicate issues related to tax reporting. For example, in many jurisdictions, businesses and traders are required to report their income and transactions accurately to tax authorities. If a platform has a high occurrence of duplicate transactions, it could create confusion regarding the actual volume of trades conducted, making it challenging to provide accurate data to tax agencies. This discrepancy could lead to audits, investigations, and potential legal liabilities for both the platform and its users.

To mitigate these risks, it is essential for platforms like Tokenim to implement robust compliance measures and ensure their transaction processing systems are transparent and accountable. They should continuously educate users on the risks associated with duplicate transactions and how to avoid practices that may raise red flags with regulatory bodies.

To minimize the occurrence of duplicate transactions, users can adopt several best practices when engaging with cryptocurrency trading platforms such as Tokenim. The first and most effective method is to double-check all transaction details before submission. This involves carefully reviewing transaction amounts, the addresses involved, and any unique metadata associated with their trades. Taking a moment to inspect these details can help prevent accidental duplicates from being submitted.

Moreover, utilizing advanced trading tools can help users make informed decisions and execute trades more efficiently. Automated trading bots or algorithms that analyze market patterns could minimize the impulsive creation of similar transactions during high-pressure scenarios. Such tools can help set predefined parameters for traders, reducing the temptation to replicate previously made trades under volatile market conditions.

Participating in trader education programs can also be instrumental in preventing duplicate transactions. Many platforms offer resources or webinars to familiarize users with undisclosed trading risks and strategies. Engaging with these materials can provide valuable insights into maximizing trading strategies while being cautious of redundancy.

Establishing a clear trading plan is another way to tackle this issue. By creating strategies that detail when to enter and exit trades, traders can follow a rational approach rather than acting impulsively based on emotive responses or market hype, which often leads to duplicate transactions. When users have a robust trading strategy, they are less likely to initiate the same trades repeatedly in succession.

Lastly, encouraging open communication within the trading community can foster shared learning experiences. Users can discuss their trading strategies, experiences with duplicate transactions, and share tips on how to avoid common pitfalls. As users support one another in their trading journeys, they contribute to a more informed and responsible trading environment.

相同交易问题在Tokenim及其他交易平台上亟待解决。通过对相同交易的深入分析,我们发现其影响深远,涉及市场流动性、用户体验、法律合规等多个方面。Tokenim需要通过系统架构、监控交易活动、教育用户等手段来有效应对这一挑战。同时,用户也应当提高自身的交易素养,以减少相同交易的发生。只有共同努力,才能为数字资产交易营造一个更加健康和透明的环境。

leave a reply